what is fit tax on paycheck

10 12 22 24 32 35 and 37. If youre an employee your employer probably withholds income tax from your paycheck and pays it to the IRS in your name.

What is Tax Withholding.

. What Is FIT Tax. These are the rates for taxes due. If we add up the two tax amounts.

This is 548350 in FIT. Federal Income Tax or FIT is the amount withheld from an employees paycheck which goes toward their Federal Income Tax liability at the end of the year. In addition beginning in 2018 the tax rates and brackets for the unearned income of a child changed.

The amount of income tax your employer withholds from your regular pay depends on two things. In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E. Federal Income Tax FIT and Federal Insurance Contributions Act FICA.

The federal government receiving the FIT taxes will typically use the funds. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Federal Unemployment Tax Act FUTA is another type of tax withheld however FUTA is paid solely by employers.

The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. For employees withholding is the amount of federal income tax withheld from your paycheck. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

Federal Income Tax in Six Questions 14032022 1322 by Clemta The federal tax is one of the main tax categories in the United States which is directly levied by IRS over the annual taxable income of individuals and legal entities. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. The 16630 added to wages for calculating income tax withholding isnt reported on Form W-2 and doesnt increase the income tax liability of the employee.

Fit stands for Federal Income Tax Withheld. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

They are all different taxes withheld. The information you give your employer on Form W4. So when you file your return youll get a credit for this amount to apply to any tax youll owe the federal government.

Since the 2018 tax year tax brackets have been set at 10 12 22 24 32 35 and 37. Your federal withholding is the amount that youve already paid the federal government. These taxes fall into two groups.

Your federal income tax withholding from your pay depends on. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. Federal income tax might be abbreviated as Fed Tax FT or FWT.

Federal taxes are the taxes that are withheld from employee paychecks. Use tab to go to the next focusable element. If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax.

Also the 16630 added to wages doesnt affect the social. The amount you earn. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

Your bracket depends on your taxable income and filing status. Some are income tax withholding. FIT Fed Income Tax SIT State Income Tax.

Imposes a progressive income tax where rates increase with income. Your net income gets calculated by removing all the deductions. In this example the employer would withhold 33 in federal income tax from the weekly wages of the nonresident alien employee.

69400 wages 44475 24925 in wages taxed at 22. You can use the Tax. What taxes are withheld from your paycheck.

For help with your withholding you may use the Tax Withholding Estimator. You pay the tax as you earn or receive income during the year. The federal income tax is a pay-as-you-go tax.

There are seven federal tax brackets for the 2021 tax year. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. 4664 548350 1014750 total.

These items go on your income tax return as payments against your income tax liability. FIT Tax refers to the federal income tax that is withheld from a W-2 employees payback on every payday.

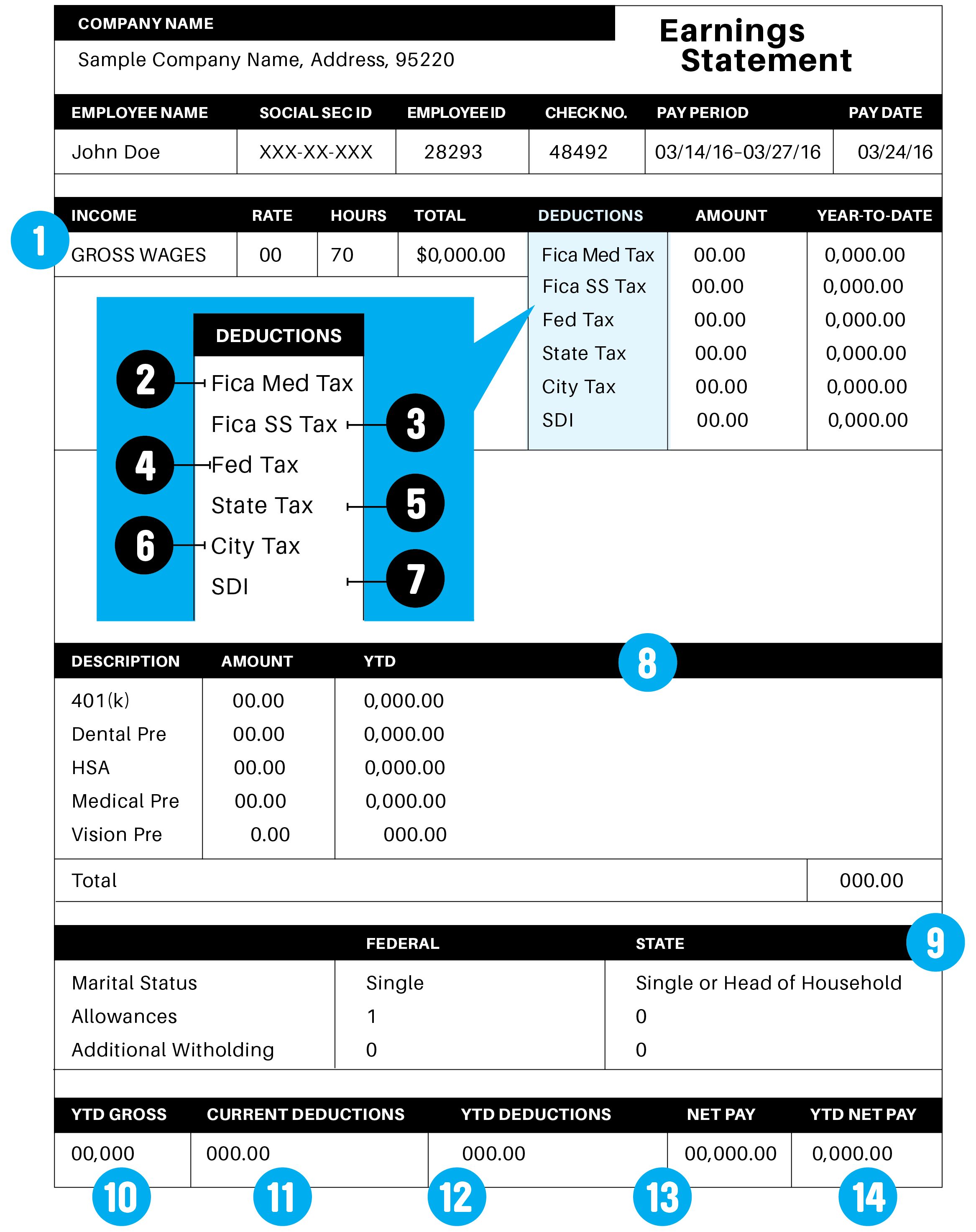

What Everything On Your Pay Stub Means Money

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats And What I Payroll Template Good Essay Templates

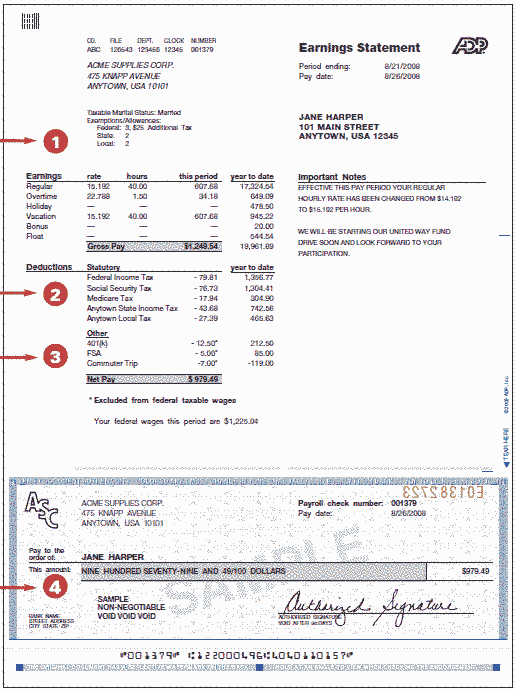

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Monthly Budget Template Budget Planner Budget Spreadsheet Etsy Budget Spreadsheet Budget Planner Monthly Budget Template

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Templates Party Invite Template Christmas Party Invitation Template

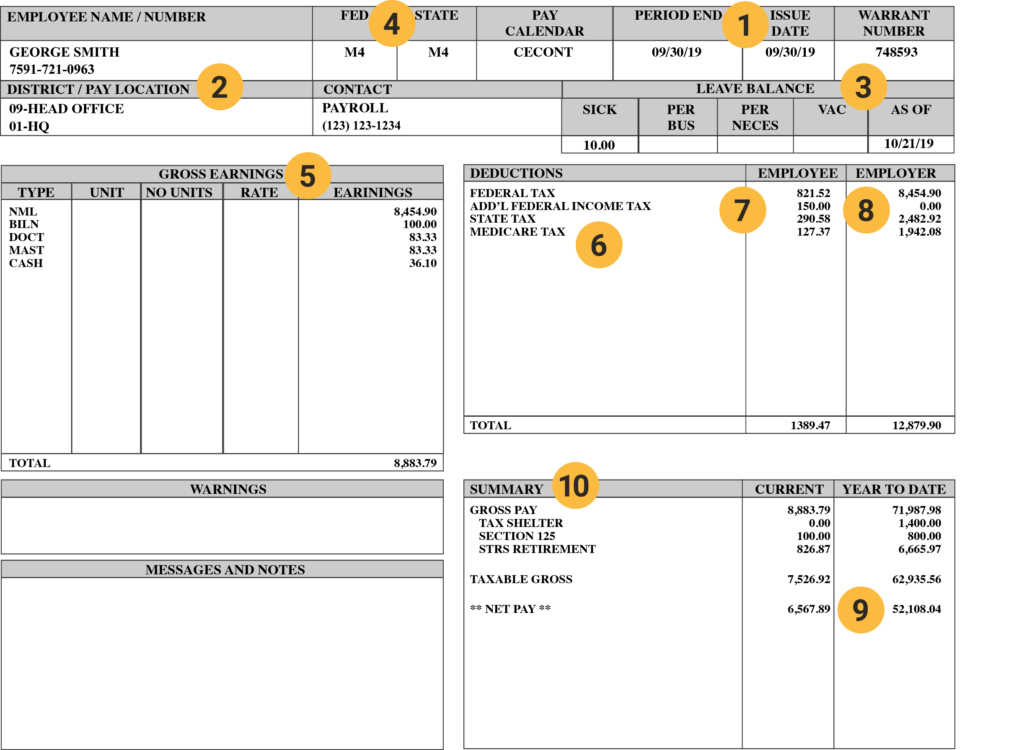

Understanding Your Pay Statement Office Of Human Resources

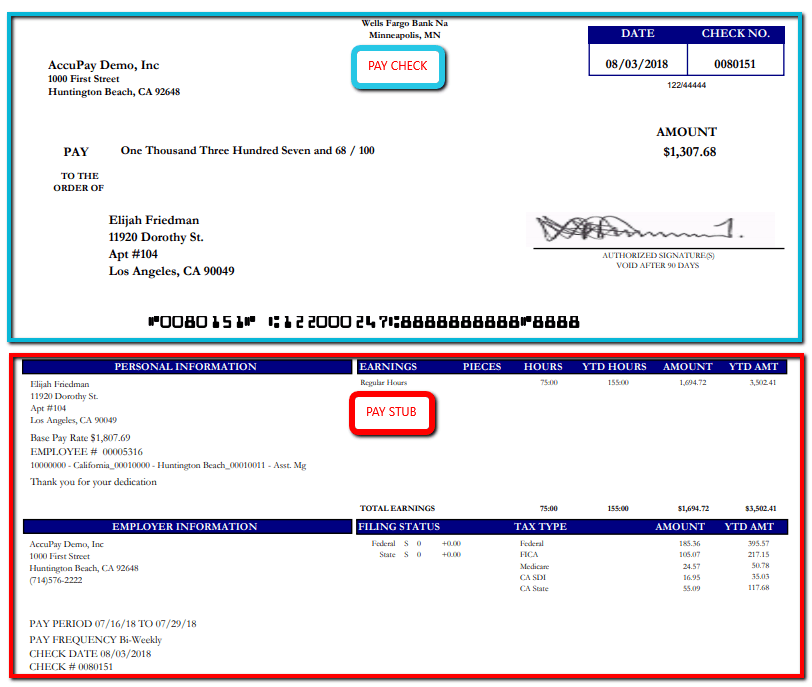

A Guide On How To Read Your Pay Stub Accupay Systems

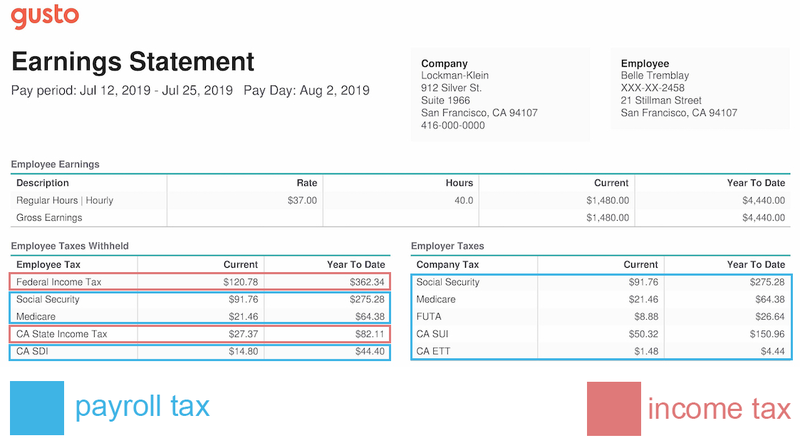

Different Types Of Payroll Deductions Gusto

Federal Income Tax Fit Payroll Tax Calculation Youtube

Understanding Your Paycheck Credit Com

Understanding Your W 2 Controller S Office

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

Payroll Tax Vs Income Tax What S The Difference The Blueprint

A Pay Stub Or Paycheck Stub Is A Document That Is Issued To By An Employer To His Her Employee As A Notification That P Payroll Checks Payroll Payroll Template

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Independent Contractor Pay Stub Template Luxury 9 Free 1099 Pay Stub Template Payroll Template Powerpoint Timeline Template Free Templates