unemployment tax forgiveness pa

The amount of withholding is calculated using the payment amount after being adjusted for earnings in any. Appeal a UC Contribution Rate.

1099 G Unemployment Compensation 1099g

As it stands the American Rescue Plan Act of 2021 which sets out to provide relief to individuals who received unemployment compensation in 2020 there is an exclusion cap up to 10200 dollars of.

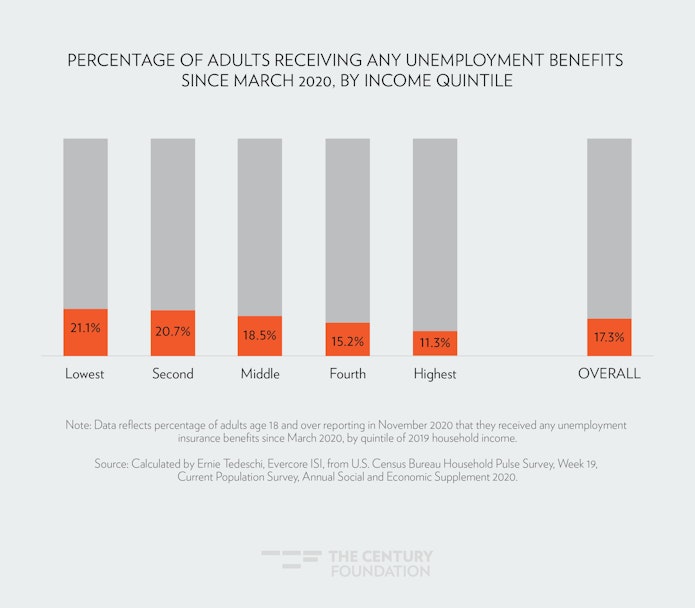

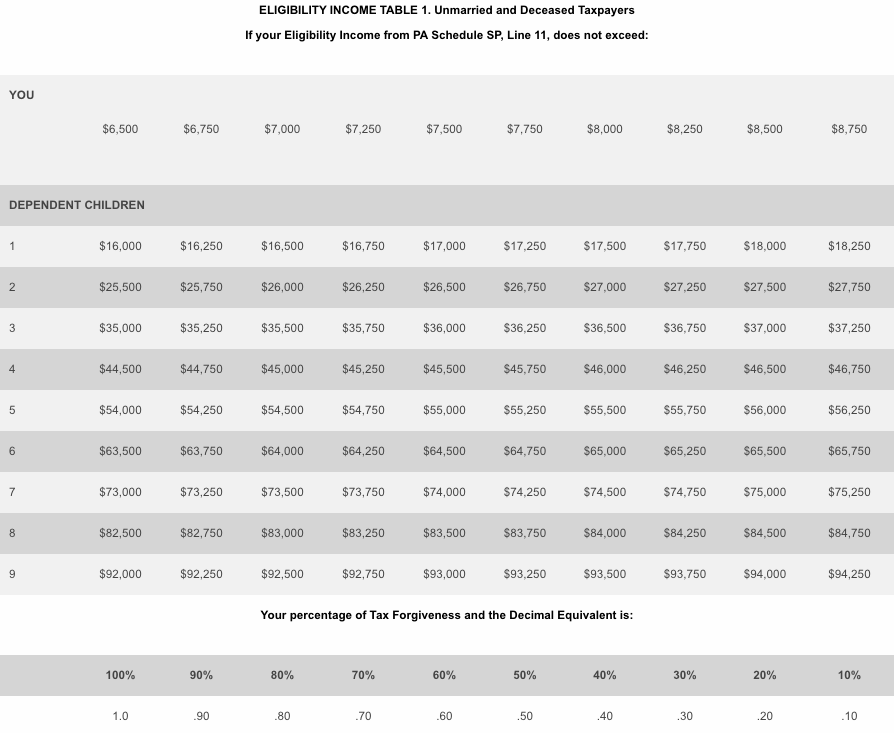

. Record tax paid to other states or countries. And a single-parent two-child family with income of up to 27750 can also qualify for Tax Forgiveness. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven.

All payments should be sent to Office of UC Benefits UI Payment Services PO. Taxpayers who receive unemployment compensation are encouraged to watch their mailboxes during the tax season for the 1099G tax form that is required to file your federal tax returns. Further to qualify for the credit it is necessary to calculate both the taxable and nontaxable income.

In Part D calculate the amount of your Tax Forgiveness. Make an Online Payment. In March 2020 Pennsylvania passed legislation requiring employers to give certain information to claimants who are separating from their employment for any reason.

Subtract Line 13 from 12. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. File and Pay Quarterly Wage and Tax Information.

Now states who opt into that forgiveness must issue refunds to workers whod repaid all or some of. Congress hasnt passed a law offering. On PA-40 Schedule SP the claimant or claimants must.

Depending on your overpayment the department can take actions to recover the amount due including taking your future UC benefits. Communication Preference Email or US Mail Addresses telephone numbers email addresses. Individuals should receive a.

To qualify for this exclusion your tax year 2020 adjusted gross. To apply for Tax Forgiveness submit a completed PA Schedule SP when you file your PA-40 personal income tax return. Report the Acquisition of a Business.

The instructions for filling out PA Schedule SP are included in PA-40 instructions available on the departments websitewwwrevenuepagovtaxforgiveness. Your eligibility income is different from your taxable income. T 1 312 302 8617.

President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020. Although unemployment compensation is not taxable for Pennsylvania personal income tax purposes this form will be an important part of preparing your tax returns. Nearly one in five households.

The purpose is to cut down on the wasted time and resources due to claimants who do not enter correct employer information when they open an unemployment claim. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. Determine the amount of Pennsylvania-taxable income.

Access UCMS and find information about starting or maintaining a business in. 2 Following the bills enactment the Pennsylvania Department of Revenue. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Record the your PA tax liability from Line 12 of your PA-40. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

5 2021 Pennsylvania enacted Act 1 of 2021 Act 1 specifically excluding forgiven Paycheck Protection Program PPP loans and economic impact payments 1 from personal income tax PIT. Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment is due to under-reported or unreported earnings. You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent.

It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired. A 900 billion relief law passed in December let states opt to waive overpayments of benefits. Tax relief can be a big help because it can reduce or even completely negate the taxes you owe.

Verifying your eligibility for Tax Forgiveness based on income tables and what forms to fill out if you qualify. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. If Line 13 is.

If none leave blank. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020. UCMS provides employers with an online platform to view andor perform the following.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Register to Do Business in PA. Apply for a Clearance.

Learn More About UCMS. Submit Amend View and Print Quarterly Tax Reports. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income.

Update Account Information eg. T 1 513 345 4540. Click here to access your PUA dashboard and change your federal withholding status or access your PUA-1099G.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. To claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SP. Get Information About Starting a Business in PA.

Learn about Pennsylvanias UC program how to apply maintaining eligibility and more. In Part D calculate the amount of your Tax Forgiveness. Not only do you include the income you report on your PA-40 but you also include but are not taxed on the.

UC Unemployment Benefits UC Handbook Overpayments and. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. It is not an automatic exemption or deduction.

Register for a UC Tax Account Number. For example a family of four couple with two dependent children can earn up to 34250 and qualify for Tax Forgiveness. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return.

The Unemployment Compensation UC program provides temporary income support if you lose your job or are working less than your full-time hours. Employers Tax Services. First figure out your eligibility income by completing a PA-40 Schedule SP.

Change My Company Address.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Your Tax Questions Answered Marketplace

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

The Case For Forgiving Taxes On Pandemic Unemployment Aid

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

2022 Federal Payroll Tax Rates Abacus Payroll

New Jersey S Current Rate Of 9 6 Percent Represents The Highest In The Area Well Above Those Of Neighboring States New Y Create Jobs New Jersey Working People